Locate a Credit Union in Cheyenne Wyoming: Your Regional Overview to Better Banking

Locate a Credit Union in Cheyenne Wyoming: Your Regional Overview to Better Banking

Blog Article

Credit Score Unions: A Smart Selection for Financial Flexibility

In a world where financial choices can significantly affect one's future, the selection of where to entrust your money and economic well-being is essential. Cooperative credit union, with their unique member-focused approach, provide a compelling alternative to standard financial institutions. By highlighting tailored services, affordable rates, and a sense of community, credit report unions stick out as a wise choice for those looking for monetary liberty. What sets them apart from various other monetary organizations? Keep tuned to discover the distinctive advantages that lending institution give the table and exactly how they can lead the way towards an extra safe financial future.

Benefits of Joining a Cooperative Credit Union

When considering financial organizations to sign up with, people might find that lending institution use distinct advantages that advertise economic freedom. One considerable advantage of cooperative credit union is their emphasis on member complete satisfaction rather than only on revenues. As member-owned organizations, cooperative credit union prioritize the needs of their participants, usually supplying more personalized solutions and a more powerful feeling of neighborhood than traditional financial institutions.

Additionally, lending institution usually give affordable rates of interest on interest-bearing accounts and loans. This can lead to greater returns on cost savings and lower loaning costs for members contrasted to larger financial establishments (Credit Union Cheyenne WY). By providing these beneficial prices, credit unions assist their participants achieve their economic objectives extra effectively

An additional benefit of credit unions is their dedication to financial education and learning. Several lending institution use workshops, workshops, and on-line resources to aid participants improve their financial literacy and make educated decisions about their cash. This concentrate on education empowers individuals to take control of their funds, ultimately bring about greater economic freedom and safety.

Lower Charges and Better Rates

Signing up with a credit union can lead to decrease costs and much better prices for members looking for financial services. In addition, credit rating unions are understood for using affordable passion rates on cost savings accounts, fundings, and credit score cards. By keeping costs low and prices competitive, credit unions intend to assist their members save cash and attain their financial goals much more effectively.

When it concerns borrowing money, credit score unions usually supply much more beneficial terms than banks. Members may profit from reduced rates of interest on car loans for different purposes, including automobile finances, home mortgages, and personal lendings. These reduced rates can lead to substantial long-term cost savings for debtors. By choosing a cooperative credit union for economic solutions, people can benefit from these cost-saving advantages and improve their total monetary well-being.

Personalized Customer Care

Lending institution separate themselves from standard financial institutions by supplying tailored client service tailored to the private demands and choices of their members. This tailored approach sets lending institution apart in the financial market, as they prioritize creating strong relationships with their members. When you walk into a credit history union, you are extra than simply an account number; you are a valued participant of a community-focused institution.

One of the vital facets of individualized consumer service at lending institution is the ability to talk directly with well-informed team that click now are bought assisting you accomplish your this financial goals. Whether you are looking to open a brand-new account, make an application for a financing, or seek financial suggestions, debt union agents are there to supply support every step of the way (Wyoming Credit Unions). This personalized touch encompasses various solutions, such as economic preparation, financial obligation consolidation, and also aid throughout times of monetary hardship. By recognizing your unique conditions, credit rating unions can supply services that are customized to your specific needs, advertising an extra supportive and favorable financial experience.

Community Involvement and Support

Stressing their dedication to regional communities, lending institution actively engage in area participation and support initiatives to foster economic development and economic literacy. By taking part in local occasions, sponsoring neighborhood programs, and sustaining philanthropic organizations, credit scores unions show their devotion to the health of the areas they offer. These institutions frequently prioritize partnerships with local businesses and companies to stimulate economic development and create opportunities for neighborhood participants.

With economic education workshops, credit report unions furnish people with the expertise and skills needed to make educated choices regarding their funds. Furthermore, they supply resources such as budgeting devices, interest-bearing accounts, and budget friendly funding alternatives to aid community members accomplish their economic goals. By promoting a culture of economic literacy and empowerment, cooperative credit union play an important role in strengthening communities and advertising financial security.

Additionally, cooperative credit union typically work together with institutions, non-profit organizations, and government firms to offer financial education and learning programs tailored to certain area needs. This collaborative strategy ensures that people of all backgrounds and ages have accessibility to the sources and assistance necessary to construct a safe financial future.

Financial Education And Learning and Resources

In accordance with why not try this out their commitment to area involvement and support, credit report unions focus on providing monetary education and learning and sources to encourage individuals in making educated monetary choices. By providing workshops, workshops, on-line resources, and individually counseling, cooperative credit union aim to enhance their participants' monetary proficiency and capacities. These academic initiatives cover a wide variety of topics, including budgeting, conserving, investing, credit rating administration, and debt payment approaches.

Financial education furnishes people with the understanding and skills needed to browse complicated monetary landscapes, causing boosted financial wellness and security. Via accessibility to these sources, individuals can create sound cash administration routines, prepare for the future, and work towards attaining their financial goals.

Additionally, cooperative credit union frequently team up with neighborhood institutions, community centers, and various other companies to expand the reach of financial education programs. By engaging with varied target markets and advertising financial proficiency at the grassroots degree, debt unions play a pivotal role in cultivating a monetarily educated and equipped culture.

Final Thought

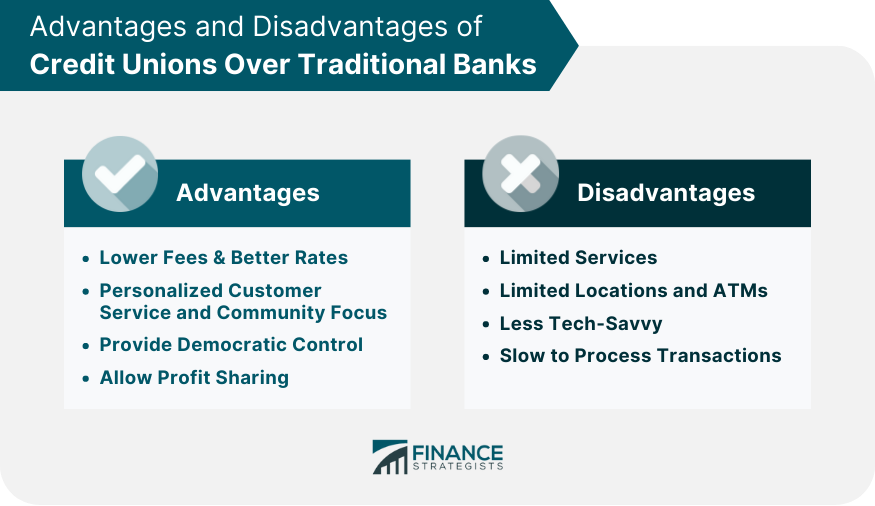

In final thought, debt unions offer numerous advantages such as reduced charges, much better prices, personalized customer support, neighborhood assistance, and economic education and learning - Wyoming Credit. By focusing on member complete satisfaction and monetary empowerment, credit history unions work as a clever choice for individuals looking for economic flexibility and stability. Joining a lending institution can aid people conserve money, accomplish their economic goals, and construct a strong financial future

When considering monetary institutions to join, individuals might locate that credit score unions use special benefits that promote monetary liberty. By picking a debt union for monetary services, individuals can take benefit of these cost-saving benefits and boost their general financial health.

In line with their dedication to neighborhood participation and assistance, credit unions prioritize supplying financial education and learning and sources to encourage individuals in making educated economic decisions. By prioritizing member complete satisfaction and economic empowerment, credit history unions offer as a clever selection for individuals looking for monetary liberty and stability. Joining a credit union can help people save cash, accomplish their financial objectives, and build a solid financial future.

Report this page